louisiana inheritance and estate transfer tax return

Time and place for filing returns. Separate property in louisiana inheritance law.

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Box 201 Amended return Baton Rouge LA.

. The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. Schedule IV Tax. Inheritance and Estate Transfer Tax Return Mark one.

The Estate Transfer Tax No current collections of the tax Equal to the maximum tax credit for state estate or inheritance tax allowed on the federal estate tax return Pick-up tax Since. R-3318 204 Louisiana Department of Revenue Mark one. Form IETT-100 Taxpayer Services Division Original return P.

Louisiana does not have an. An estate tax return shall be mailed to both the collector of revenue and the person designated as the tax collector under the provisions of RS. The Economic Growth and Tax Relief Reconciliation Act.

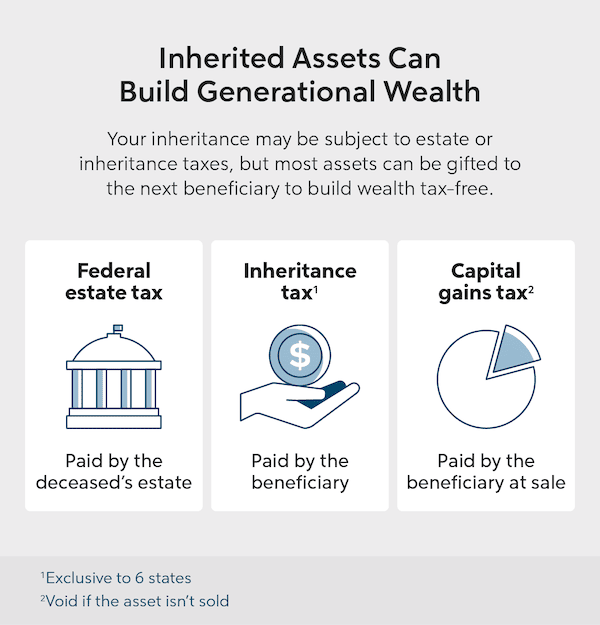

Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. The estate would then be given a federal tax credit for the. An inheritance tax return Form IETT-100 must accompany this affidavit if the.

While the estate is responsible for paying estate taxes beneficiaries must pay inheritance tax. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more.

Executors must file the following if the estate exceeds a value of 11180000. Original return Amended return Partial return Date of originalaaa Real estate Louisiana property only. Louisiana Inheritance and Gift Tax.

Texas T E Lawyer S Roadmap To Louisiana Law Ppt Download

Estate Planning For Louisiana Attorney John R Harris

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Free Louisiana Last Will And Testament Template Pdf Word Eforms

Estate Planning For Louisiana Attorney John R Harris

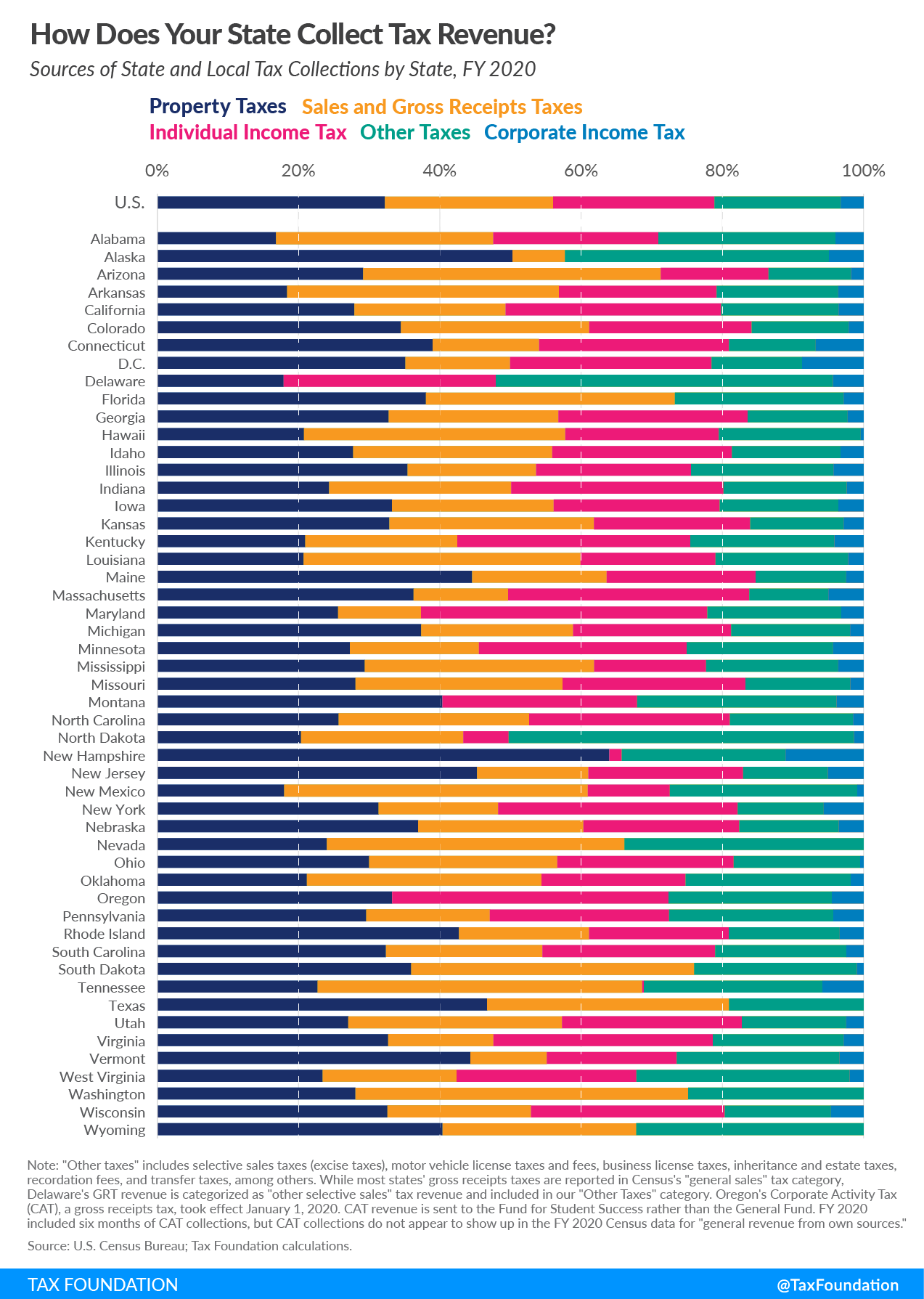

State And Local Tax Collections State And Local Tax Revenue By State

Extension To File Inheritance Tax Return Rev 1846 Pdf Fpdf Docx Pennsylvania

Louisiana Succession Taxes Scott Vicknair Law

Louisiana Inheritance Tax Estate Tax And Gift Tax

How Do State And Local Property Taxes Work Tax Policy Center

![]()

Louisiana Succession Taxes Scott Vicknair Law

Sales Tax Amnesty Programs By State Sales Tax Institute

What Is A Transfer Tax Definition And How It Works With Inheritances

What Is A Step Up In Basis And How Does It Work Quicken Loans

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Louisiana Probate Forms Signnow

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation