excise tax nc formula

Submit a completed Non-Resident Military Affidavit for Exemption of Excise Tax. Excise or Railroad Retirement Tax Act RRTA Three years from the due date of return without regard to any extension.

Pdf Excise Tax Calculation For The Eu Member States Third Countries Using Sap Cloud Solution Scp

Filed under IRC 6020b1 Returns Executed by Secretary.

. Boosted money for a federal conservation program to a record level in 2022 officials announced Friday. 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0. Com at any time after your card has been printed and mailed to you.

Or three years from the date return was filed. Sets forth a schedule of applicable amounts upon which such fee is based for calendar years between 2014 and 2018. Key provisions of the new law removed the cap on the number of vehicles that may participate increased the minimum miles per gallon mpg rating by three to 20 MPG replaced the per-mile charge with a formula equal to 5 of the states per-gallon gasoline license tax and ended refunds to participants paying more in fuel taxes than what was owed in per-mile charges.

Withholding FICA Excise or RRTA returns that are. This deduction may be claimed only in the year. Repeals the excise tax on medical devices enacted by PPACA.

Allows a reduced fee for tax-exempt insurance providers. 1406 Delays until 2014 the annual fee on the net premium income of health insurance providers. AP Tax receipts from surging gun and ammunition sales in the US.

Order Online 72 144-Hour PermitsThe Texas Department of Motor Vehicles also issues 30-day permits for the temporary movement of a vehicle subject to Texas registration law. 2 E STIMATED TAXESFor purposes of applying section 6654 of the Internal Revenue Code of 1986 to any taxable year which includes any part of the payroll tax deferral period 50 percent of the of the taxes imposed under section 1401a of such Code for the payroll tax deferral period shall not be treated as taxes to which such section 6654 applies. Willful attempt to evade tax.

Free and fast temporary emails in 2. 14 The amount by which the basis of a depreciable asset is required to be reduced under the Code for federal tax purposes because of a tax credit allowed against the corporations federal income tax liability or because of a grant allowed under section 1603 of the American Recovery and Reinvestment Tax Act of 2009 PL.

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Pdf Excise Tax Calculation For The Eu Member States Third Countries Using Sap Cloud Solution Scp

Car Tax By State Usa Manual Car Sales Tax Calculator

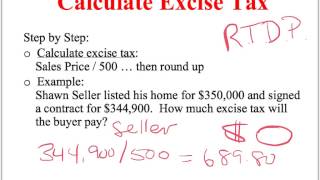

Calculating Excise Tax Youtube

Calculation Of Minimum Cigarette Sale Prices Adapted From Michael J Download Scientific Diagram